♠ Posted by Emmanuel in Cheneynomics,Trade

at 4/15/2008 01:33:00 AM

It is truly perplexing why the most influential economic commentator in the 21st century is, er, Dick Cheney. In a well-quoted passage from former US Treasury Secretary Paul O'Neill's book The Price of Loyalty, Dick Cheney reportedly told O'Neill "Reagan proved that deficits don't matter." If you are unfamiliar with the cottage industry which repeats this idea that "deficits don't matter, read Barry Eichengreen's easy-to-read summary about them.Anyway, I am unsure why Brad Setser (in whom we trust) has resurrected an old warhorse from the graveyard of "deficits don't matter"-style intellectual bankruptcy care of Fed Chairman Ben Bernanke. After reading the latest data on world savings, he made a new post entitled "Case closed: A savings glut, not an investment drought." You can read his take on the matter. I, however, beg to differ. Let us begin with the terminology: if there were indeed a global savings glut, by implication there would be a marked rise in global savings levels. What does the data indicate? Let us turn to table A16 from the April 2008 World Economic Outlook:

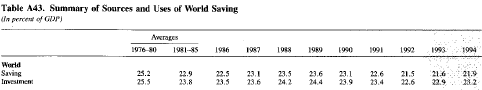

Yes, the world savings rate has gone up to 23.7% of world GDP in 2007 from an average of 22.7% for the period of 1986 to 1993. To be frank, a 1% increase in savings does not seem to represent a glut to me. If it were considered a glut, then why shouldn't it have been a glut back then? Using this data to demonstrate a "global savings glut" is iffy. Now, let me bring you to the clincher: global savings averaged 25.2% in the period of 1976 to 1980. Then, as now, Middle East oil exporters were like the little old lady who lived in a

Yes, the world savings rate has gone up to 23.7% of world GDP in 2007 from an average of 22.7% for the period of 1986 to 1993. To be frank, a 1% increase in savings does not seem to represent a glut to me. If it were considered a glut, then why shouldn't it have been a glut back then? Using this data to demonstrate a "global savings glut" is iffy. Now, let me bring you to the clincher: global savings averaged 25.2% in the period of 1976 to 1980. Then, as now, Middle East oil exporters were like the little old lady who lived in a

So, if we follow the Cheneynomic argument made by Bernanke, the period between 1976 to 1980 must have been a period of a mega-global savings glut. However, we get no sense of that in his speech. Instead, we get the rather Amerocentric explanation that the US is somehow being "forced" to absorb the rest of the world's savings because the sum of all current account balances must balance out. This, of course, is riddled with problems regarding causality. In the end, it's simply a case of some folks spending too much on housing and consumer goods (America) and other folks gaining a windfall from energy (Middle East) and goods (China) exports. From a logical standpoint, I tend to think that the actions of the former are driving those of the latter and not vice-versa as Bernanke would suggest.

Thus, the "global savings glut" is laid to rest. If you want a better explanation of why this theory got out into the open, consider that Bernanke made the speech on 10 March 2005. Back then, he was not Fed chairman but merely one of those vying to be Fed chairman. Being in the position of wanting to be Greenspan's replacement, Bernanke had to cotton up to the Bush administration and its unprecedented deficit running ways. One of the first rules of employment, of course, is "don't make the boss look bad." Imagine what would have happened instead if Bernanke made a speech about the profligacy of the Bush administration. Of course, he would not have gotten the job as Fed chairman. That counterfactual didn't pan out as we got "deficits don't matter...because there's a global savings glut." How convenient; on 24 October 2005, he was appointed as the new Fed chairman. It was smart politics on Bernanke's part, not good economics. Well, isn't that special?

As for me, I will have none of this Cheneynomics. Even bigwigs like the Fed chairman and Joseph Stiglitz will try to pull whoppers like this every now and again. Do your homework, though, and you can easily spot them. Repeat after me: There is no such thing as a free lunch--or a global savings glut, dark matter, new economy, Sasquatch, or Bigfoot for that matter.